What’s Actually Going on with Regional Sports Networks?

Diamond Sports Group’s collapse despite strong local sports viewership highlights a broken RSN model.

There has been much chatter about regional sports networks (“RSNs”) since Diamond Sports Group filed for bankruptcy in March 2023. Diamond Sports Group (“DSG”), via subsidiary Bally Sports, operates 19 RSNs; owns local broadcasting rights for nearly half of all NBA, MLB, and NHL teams; and produces 5,000 live sports broadcasts annually.

What went wrong? In short, local sports viewership trends remain favorable, but the ‘unbundling’ of RSNs from cable and other pay television packages is ending non-sports viewer subsidization and driving an 80%+ decrease in RSN revenue. The traditional RSN model has broken as a result, and Diamond Sports Group is the first to go bust. Many teams are already transitioning to new local viewership formats that present less revenue in the short term but greater accessibility over the long term, standing to boost viewership, fandom, and hopefully value.

Regional Sports Networks and Local Sports Viewership

Diamond Sports Group, formerly Fox Sports Networks, was acquired by Sinclair Broadcasting Group from Disney for $10.6B in 2019 (S&P Global). Its business model is simple: DSG pays “annual fees… in the neighborhood of roughly $40M per team” for the exclusive right to broadcast local games on its 19 Bally Sports-branded regional sports networks (SBJ). Cable and other pay television partners (collectively, “cable” partners) in turn pay DSG to include Bally Sports in their channel bundles. DSG also earns advertising revenue and recently began selling access to local games direct-to-consumer (“DTC”) via its Bally Sports+ streaming service.

As background, there are three types of live sports broadcasts: national, local, and out-of-market. DSG and other RSNs strictly offer local broadcasts, according to the below NBA and New Orleans Pelicans example:

National: Turner (Warner Bros. Discovery) and ESPN (Disney) pay the NBA a combined $2.7B per season to broadcast 240 and 100 national games, respectively (Forbes). Twelve Pelicans games will be broadcast nationally by Turner and ESPN during the 2023-24 season, with slight variance due to the NBA In-Season Tournament.

Local: Bally Sports New Orleans (Diamond Sports Group) broadcasts all Pelicans games locally, save for some national games. Seventy-eight Pelicans games will be broadcast locally by Bally Sports New Orleans during the 2023-24 season.

Out-of-market: the NBA retains out-of-market rights to local broadcasts, which it sells to consumers via subscription streaming service NBA League Pass. Pelicans local broadcasts are available out-of-market (e.g., in Boise, Idaho) on NBA League Pass.

Local sports viewership remains strong across leagues. NBA RSN viewership grew 2% year-over-year for the 2022-23 season while Bally Sports viewership specifically grew 20% (Yahoo! Sports, The Athletic). Local NBA broadcasts performed far better than national broadcasts when weighted by market size, averaging ~40k household impressions vs. ~26k for TNT’s national broadcasts and ~21k for ESPN’s (The Athletic). MLB RSN viewership grew 7% for the 2022-23 season while the NHL is seeing 12% growth to start the 2023-24 season (Forbes, SBJ).

Despite strong viewership, RSNs like DSG face pressure due to the ‘unbundling’ of RSNs from cable packages, exacerbated by the decline of pay television overall.

The Great Unbundling

Cable and other pay television providers offer channel bundles to subscribers at a fixed monthly or annual rate. Historically, subscribers have had limited ability to buy channels à la carte, and RSNs were included in bundles because, well, what cable provider wouldn’t offer Knicks games to customers in New York City?

The rise of streaming created competition for eyeballs and spawned consumers who expect affordable and accessible entertainment. Cable providers have been forced to rethink which channels they include in bundles to keep down costs to subscribers. Per S&P Global’s Kagan, RSNs charge cable partners royalties upwards of $5 per month per subscriber, making them the costliest channels to carry besides ESPN (Yahoo! Finance). To boot, Comcast Xfinity viewership data suggest that 95% of subscribers watch less than one sports game per week on RSNs (CNBC).

Accordingly, cable and other pay television partners are dropping costly RSNs from their bundles. DISH, for example, cut DSG in July 2019, months before the Sinclair acquisition was finalized. DISH had 11M subscribers at the time, making it the fourth-largest pay television provider in the U.S. (CNBC). In DISH’s own words when cutting New England Sports Network in 2021, “this model requires nearly all customers to pay for RSNs when only a small percentage of customers actually watch them… we no longer think it makes sense to include them in our TV lineup” (Boston.com). DISH is simply one of many providers cutting RSNs: YouTube TV only carries some RSNs while Comcast Xfinity did the once-unthinkable and dropped MSG, which broadcasts Knicks games in New York City, in late 2021.

21st Century Fox may have forced partners to carry Fox Sports Networks at risk of losing other Fox channels, but DSG and many other RSNs lack such leverage as standalone entities.

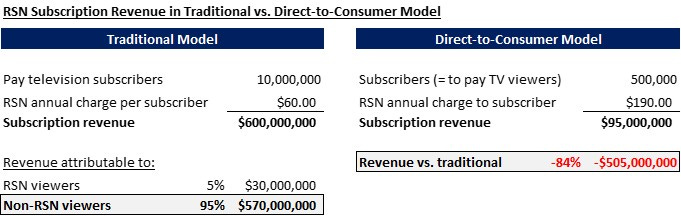

Getting the axe from partners like DISH has drastic financial implications for RSNs, even assuming they can sell programming to all lost sports viewers DTC through a solution such as Bally Sports+. In the exhibit below, the “Traditional Model” uses Kagan’s RSN pricing data and Comcast Xfinity’s viewership data to calculate subscription revenue from viewers vs. non-viewers in a partnership of DISH’s scale (e.g., ~10M pay television subscribers). The “Direct-to-Consumer Model” uses Bally Sports+ annual pricing and the same viewership estimate (e.g., 5% of the 10M subscribers) to highlight lost revenue in a departure from the traditional bundled model.

The findings are startling. Traditionally, an RSN would earn ~$570M in revenue annually from non-viewers in a 10M person customer base, with viewers only contributing ~$30M. Even if all viewers are retained following a 3x price increase in a DTC approach, subscription revenue decreases a staggering 80%+. This before considering any impact from ‘cord cutting’ that has seen consumers ditch pay television altogether.

As one Reddit user artfully quipped, “Aunt Susie is no longer subsidizing the NBA.”

Saddled with $8B+ in debt from the Sinclair acquisition and committed to costly team rights deals signed in a bygone day, it’s no wonder that Diamond Sports Groups went bust. The traditional RSN business model has broken, and the writing was on the wall before Sinclair’s multi-billion-dollar DSG mistake. Other RSNs may not face the same acquisition-related pressure, and advertising revenue will slightly mute the impact of lost subscribers for all RSNs, but the traditional model seems nonetheless unviable.

RSN direct-to-consumer streaming services such as Bally Sports+ will help capture some lost revenue but give remaining cable partners full license to drop RSNs from their channel bundles.

What About the Fans?

DSG owes nearly $2B in delinquent team rights fees but will continue to broadcast NBA and NHL games through the 2023-24 season before local broadcast rights revert to leagues and DSG enters its new reality (Bloomberg, NBA). Fans will maintain access to games in the short term via a patchwork of formats that vary by market and by game within markets:

Bally Sports RSNs via remaining cable partnerships and/or DTC streaming service Bally Sports+

Solvent RSNs via remaining cable partnerships and/or DTC streaming services

Team DTC streaming services such as Jazz+, Suns Live, and ClipperVision

League DTC streaming services such as MLB.tv

Free ‘over-the-air’ broadcast television

Team streaming services such as Jazz+ offer a glimpse into how many teams could approach local distribution when remaining RSN contracts expire. The Utah Jazz launched Jazz+ in June, and the service allows local viewers to watch all pre-season and regular season games not broadcasted nationally for $125.50 annually, $15.50 monthly, or $5.00 per game.

Other NBA teams such as the Atlanta Hawks and New Orleans Pelicans have finalized deals to broadcast up to 10 games during the 2023-24 season for free on ‘over-the-air’ broadcast television, per an allowance in DSG’s bankruptcy proceedings. The maximum number of households that can watch Pelicans games will increase from 700k to 7M on the 10 free broadcasts on Gray Television’s WVUE-Fox (SBJ).

Meanwhile, the MLB will stream games in local markets for at least two teams, the Arizona Diamondbacks and San Diego Padres, on its out-of-market streaming service MLB.tv. Reports are that the MLB believes that “even the still-lucrative iterations of RSNs are a sinking ship,” and Commissioner Rob Manfred states that a switch to league-run streaming “gives people more flexibility, more reach and [is] better for fans overall” (Yahoo! Sports).

Bringing it All Together

DSG’s collapse raises important questions about the future of local sports broadcasting at a crucial time for leagues, particularly for the NBA as it begins to explore its next cornerstone national media deal. Teams will take a financial hit in the transition away from the traditional RSN model, which provided fixed, non-viewer-subsidized cash flows that historically constituted ~15% and ~20-30% of NBA and MLB team revenue, respectively (The Athletic, Forbes). However, interest in local sports remains strong, and a fresh approach to broadcasting will bring accessibility gains and boost viewership, fandom, and hopefully team value over the long term.

Teams may yet thread the needle between guaranteed rights payments and easy access for fans. Per Axios, Amazon is exploring an investment in DSG, which would add local sports to the tech giant’s expanding library of sports content, while DirecTV, Disney, and Google are also expected to vie for local NBA rights “if they can obtain a critical mass of teams” (Axios, Awful Announcing). It seems a matter of when, not if, large streaming providers enter the local broadcasting equation in a major way.

If anything, the situation remains dynamic, but a fresh approach to local sports seems likely to benefit leagues and their #1 asset: fans.